Aave’s Latest Move for Institutional Adoption

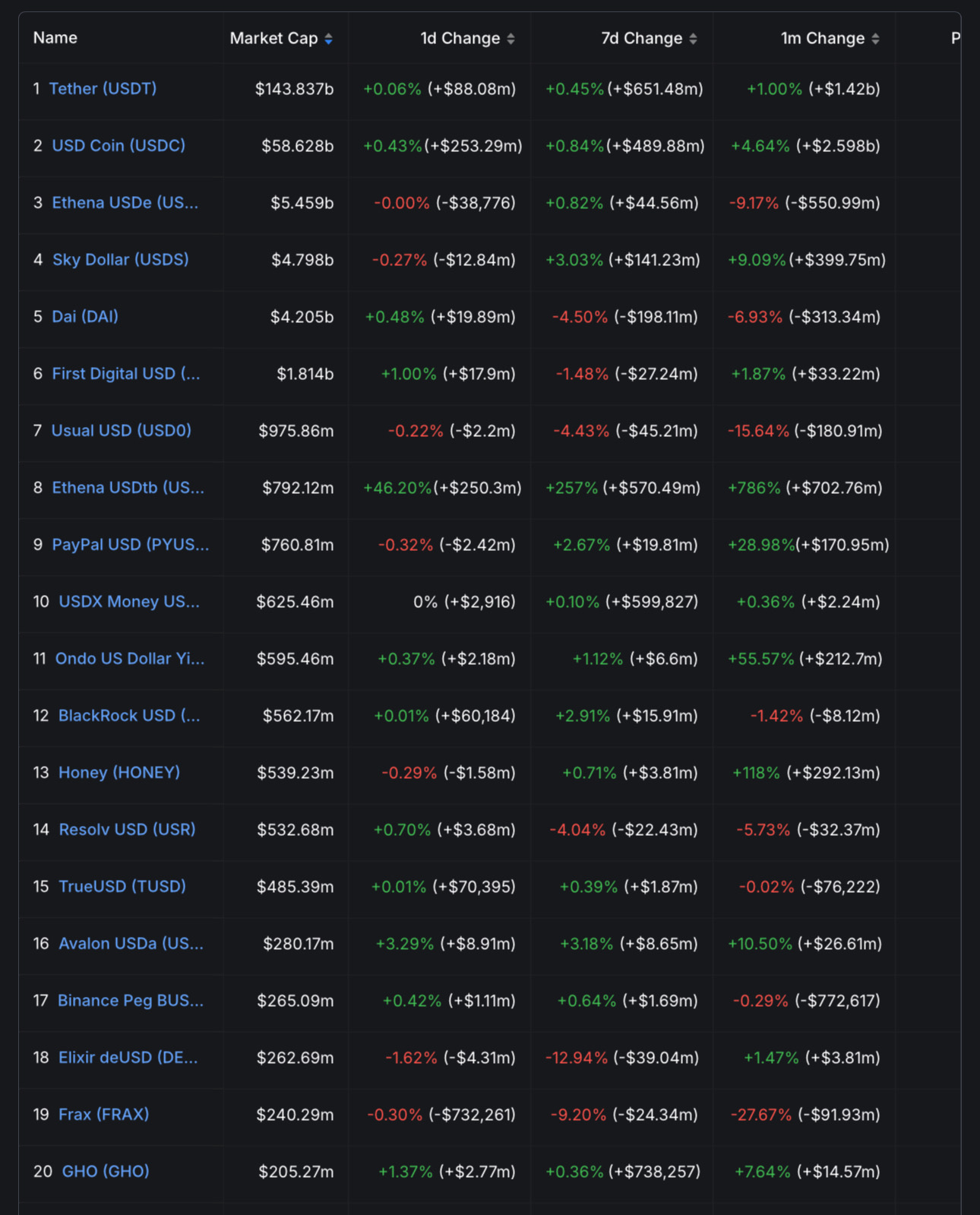

Aave's $GHO now ranks the 20th stablecoin by mcap at $200M+ onDefiLlama. Not shining colors but few days ago Stani proposed the launch of Horizon to make $GHO the go-to for institutional borrowing. And it's their 2nd attempt for institutional DeFi through RWA.

Will this be a wagmi or ngmi? Is DeFi 2.0 making a comeback for institutional adoption? A post on everything you needa know.

What's Horizon? Explain to me l'm five shincha

⚪️ It is Aave's new institutional DeFi play

⚪️ First product kicks off with tokenized money market funds (MMFs) as collateral for borrowing $GHO and $USDC

⚪️ Protocol mechanism adopts a hybrid design with two core elements:

(i) permissioned RWAs = MMFs are restricted with KYC/AML standards;

(ii) On the flip side there is permissionless liquidity, meaning that permissioned MMF will be posted as collateral where retail users + DAOs can interact it freely via Aave V3.

⚪️ The whole Horizon debut evolves @aave arc: To understand this here's some background info.

Arc was an earlier Aave experiment launched in 2021 for institutional defi. It's permissioned meaning that every part of its assets, users and interactions was restricted. Only whitelisted institutions with KYC/AML checks could participate. They'd deposit assets like tokenized bonds to borrow stablecoins. It peaked at $100M TVL but didn't scale big becoz it lacked DeFi's open, flexible vibe.

Horizone takes Arc's insti focus and upgrades it with the hybrid twist. Unlike Arc, Horizon doesn't lock everything down. The assets are permissioned but once they're in Aave's pools, anyone can interact with them. You can think of it closer to Ondo's OUSG.

How this will benefit for $AAVE holders? Shinchan bought $AAVE at 300 and bags went down bad

(1) Revenue sharing from Horizon

Temp check proposal states 50% of Horizon's first-year revenue will go to Aave DAO which $AAVE holders govern. Potential ways for more buybacks?

(2) Boosted $GHO adoption will drive $AAVE utility

Horizon prioritizes Aave's stablecoin $GHO as a key borrowing asset for insti. It aims to "establish $GHO as a key liquidity source". As $GHO demand rises, $AAVE staking in safety module reduces $GHO borrowing rates to incentivize holders to lock tokens + earn rewards. More $GHO circulation could stability its peg to enhance the credibility of $AAVE.

Will there be a new token for Horizon's launch? They did propose it but people disliked it

It was indeed mentioned in the temp check proposal but seems $AAVE holders are generally negative with this.

Reasons?

- Value dilution: Fears a new token reduces $AAVE's value accrual + relevance.

- Revenue share: There will be a declining revenue share from Horizon to $AAVE DAO, which the new token launch might hit a weaker tie to $AAVE holders.

Marc Zellar also blasted against the Horizon new token idea on X.

These concerns were not ungrounded and holders could base it with relevance to what happened to MakerDAO's transformation into Sky. In Aug 2024, MakerDAO rebranded to Sky and introduced new tokens $USDS (upgraded $DAI) and $SKY (upgraded $MKR). $MKR holders could convert each $MKR into 24,000 $SKY. Old tokens remain functional but are being phased out. Post-rebrand, $MKR price slid caused a net loss in purchasing power. Right now DAO introduced buybacks for $MKR to stabilize price as remedial.

Shinchan will see how this goes in proposal voting but likely a token-free horizon is what's asked for.